- Mid Session

- Posts

- The Curse Of Perfectionism In Trading

The Curse Of Perfectionism In Trading

Just get in the trade. Just stay in the trade. Traders tend to become perfectionists in the markets to avoid pain. "If we just refine more," "if we just tweak our plan like this," "if we change our management strategy"--- maybe we'll avoid more pain associated with taking losses.

The curse of perfectionism in trading

Just get in the trade. Just stay in the trade. Traders tend to become perfectionists in the markets to avoid pain. "If we just refine more," "if we just tweak our plan like this," "if we change our management strategy"--- maybe we'll avoid more pain associated with taking losses.

When it comes down to it, trading is an imperfect sport. We can sit there for hours on end studying the technical aspects of the market but the reality is the market will always vary. We have to both broaden our technical arsenal and narrow our focus. I know that's a bit of an oxymoron but let's try to break it down.

1. We determine our own standards.

Only you know what you are capable of. From work ethic and output to motivation and hunger. It's important to audit yourself from time to time to understand your baseline. Where have you progressed? Where do you still need work? Are you still doing the things that give you success? Are you still doing the things that hold you back?

Step back and assess yourself. Define your own standards and ask yourself if you're meeting them. Obsessing about mistakes, feeling like you're letting yourself or others down, or holding yourself to impossibly high standards. These are things might pull on those strings that make you wonder "why aren't I there yet?"

Determine your baseline. Make progress. Eliminate the things that don't positively effect your progress.

2. Increase your knowledge AND act on it.

Traders love saying they are a "student of the markets." That's great and all but at some point you need to sit still, buckle in, and ride that big brain of yours to profitability. You don't need to be the Einstein of trading - you just need to have a handful of reliable and trustworthy setups with a reasonably predictable outcome.

Often we think that if we had a little more technical understanding we'll be millionaires in no time. Like that's clearly the problem we need to solve. In reality, the issue is we just need to act on the knowledge we already have. If you've been staring at the charts for the better part of a year and properly applying yourself and asking the right questions- chances are you already know enough to squeeze a bit of cash out of these markets.

3. You're not taking the risk.

OK- Here's the deal. When we describe and ideal setup and everything plays out we're ready to smash our orders right? But what happens when we don't get the perfect setup? Or maybe we missed the perfect setup because it was 20 minutes before we got to the charts? Then what? We need to understand that we might get a perfect setup once or twice a month- outside of that the majority of our setups are going to vary.. and it's going to cause hesitation.

As you develop experience and you reflect (do your EOD markups and journal you turd) you will understand that not every setup is perfect and you're not always going to be in the right place at the right time. Soooo you need to learn to take the risk outside of your "perfect" setup. Or sit on your ass and be ok missing out on the market today.

4. M1 charts are for perfectionists.

You. Do. Not. Need. To. Trade. The. m1. Charts.

Trading the m1 is for very very detail oriented people. Not everyone has that ability and that's OK. Don't let IG or Twitter or your Discord community make you feel like that's the only way to make money. At the end of the day you either can or you can't. But only you can decide where your strengths lay. You can be a god as market direction and POI selection but maybe your entries aren't as good and you take losses before the trade runs in your direction. What should you do? Be honest with yourself and ask yourself the right question: How can I get in this trade, stay in this trade and make money?

Experiment - play around with entering on other timeframes. See what makes trading comfortable for you. At the end of the day no one cares about your P/L other than you.

Bottom line- The market is not perfect, we are not perfect. All we can do is give ourselves the best chance to get in, stay in and make some profit. Do it how it fits your personality. Work hard to understand the technicals but focus on you and your baseline. Have reasonable goals and don't change things when they are working. Double down and flow with the markets.

Thanks for joining me for this Mid Session- Hope to see you on the next one.

-BW

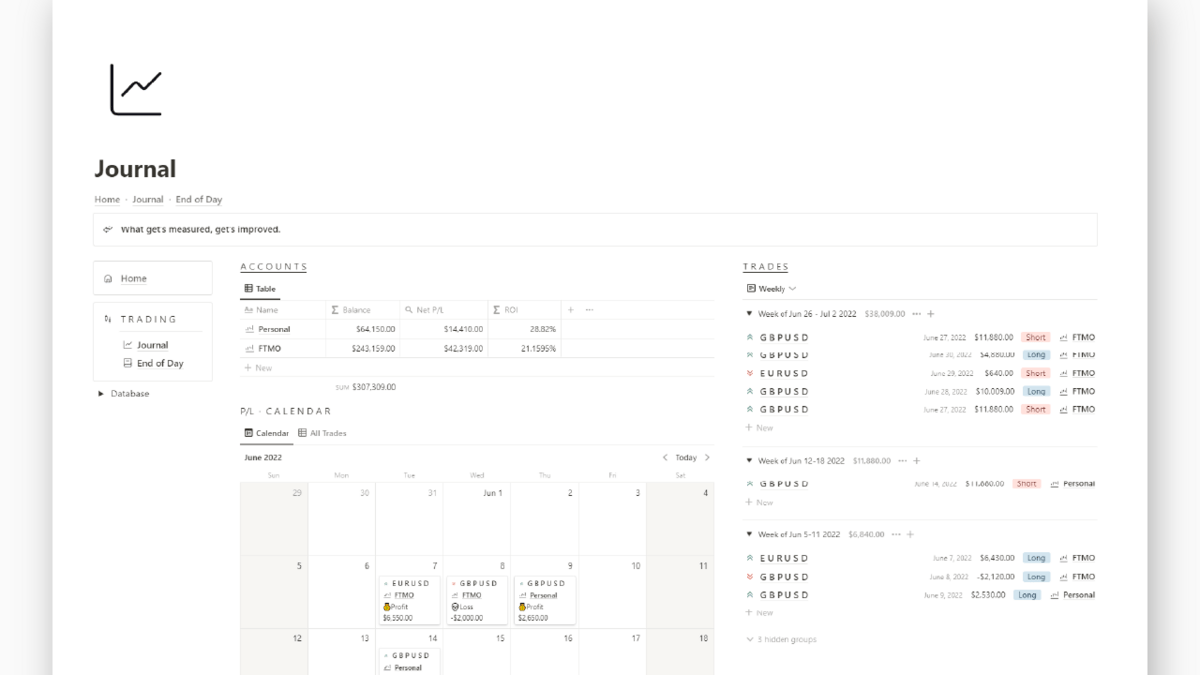

Don't forget- Journaling your trades is probably the best way to truly track your performance and improve your trading. However you do it, just do it. Check below for my Trading Journal- I use Notion and it makes life 100% easier and keeps my trading sharp.

While you wait for the next issue, check out some of my previous posts here:

I'm the leading advocate for journaling your trades

Every other day you're going to hear me talk about journaling your trades. It's a massive pain in the ass- especially if you tend to overtrade.. I get it. But I can't stress how important it is to track your metrics.

Every successful entrepreneur monitors their KPIs (Key Performance Indicators) -- These are the metrics that tell you whether you are profitable or not and what areas you need to improve in. I've built a hefty Notion template to help you journal your trades. Track your KPIs as well as your daily, weekly, monthly, annual performance. I've also included an End Of Day Markup tool to help you define your edge or keep your edge sharp, if you've already got on. Grab it below. For reading this far and trusting me with your time I'm taking 20% off.

Follow me on twitter

If you don't have the will to act on your knowledge your knowledge is worthless.

— B L A C K W A T C H (@BLVKWATCH)

6:54 PM • Sep 16, 2022