- Mid Session

- Posts

- What Are Our Limitations?

What Are Our Limitations?

Traders often need to limit their expectations, market exposure, chart time, emotions, trades etc.

What Are Our Limitations?

Traders often need to limit their expectations, market exposure, chart time, emotions, trades etc. The list goes on- It's important to understand when we are over doing it and what our baseline should be.

Lim·it: something that bounds, restrains, or confines.

The word “limit” is an interesting one. This single word has many different applications that effect how we navigate the markets. From simple trading terminology to impulsive behaviors to self control, the word “limit is an important one.

One thing I can say for certain after 3 years of mentoring day traders: technical analysis is not the most important aspect of trading. Obviously it’s crucial to building a consistent edge but, at the end of the day, most traders suffer from things such as limiting beliefs and various self control issues.

1. Limiting Beliefs

The entire purpose of getting data behind your edge is to build confidence, but too often traders will put in minimal work and take the advice of peers or mentors without applying it themselves. There is an inherent trust in these people for various reasons, but the bottom line is that this will not build confidence in their own trading without putting in the work. The idea of limiting beliefs is that one is aware of what is possible but are not confident in themselves to yield these results.

All traders need to have a breakthrough moment. A moment where we “break” through a barrier and see their own capabilities. To “break” through means you need to break something— a limiting belief, a habit, routine, rut, need for social validation, ideas held by those close to you. Limiting beliefs are often about our selves and our self-identity. Break that barrier - Push the boundaries. Do that by building confidence through your data, through your hard work.

2. Limiting Yourself

Self control and impulse control are substantial issues in most trader’s careers— especially early on, where many bad habits are formed. There’s an inherent need to be at the charts at all times. This is primarily due to the learning phase of their trading. It’s almost impossible to pickup the technical skillset you need to be profitable in the markets without spending hours at the charts. The fact is — it’s a necessary evil.. but there are good approaches and poor approaches. You can read about Hyper Blocks for focused work here.

At a certain point we need to come away from the learning phase and start implementing the execution phase. This is arguably the most important part of any traders career but is also the most neglected or poorly executed. Traders tend to carry a lot of the early learning habits into the live market which almost always results in over trading and over management.

Another reason traders spend too much time at the charts is that we don’t always trust the data. We lose sight of the notion that “there will always be more trades” and we live like every trade is the end or beginning of our career. In order to properly execute this phase of your journey we need to learn what to limit.

Limit your risk. Limit your exposure. Limit your trading. Limit your emotions. Limit how much you check on your trades.

Nearly all of these issues can be solved by limiting your time at the charts.

It’s good to have specific times when you will trade and when you will not. It’s also good to limit how much chart time you put in for studying. It’s important to remain focused and detailed— having 10 hour study sessions will have diminishing returns. This is why I prefer to do things in 4 hour hyper blocks.

At the end of the day the most important thing is your progress. Some things you have control over.. some things you do not. Everything in this article is what you have control over.

(Oh.. and limit your need for social validation. Build confidence through yourself.)

Thanks for joining me for this Mid Session chat- See you next time.

-BW

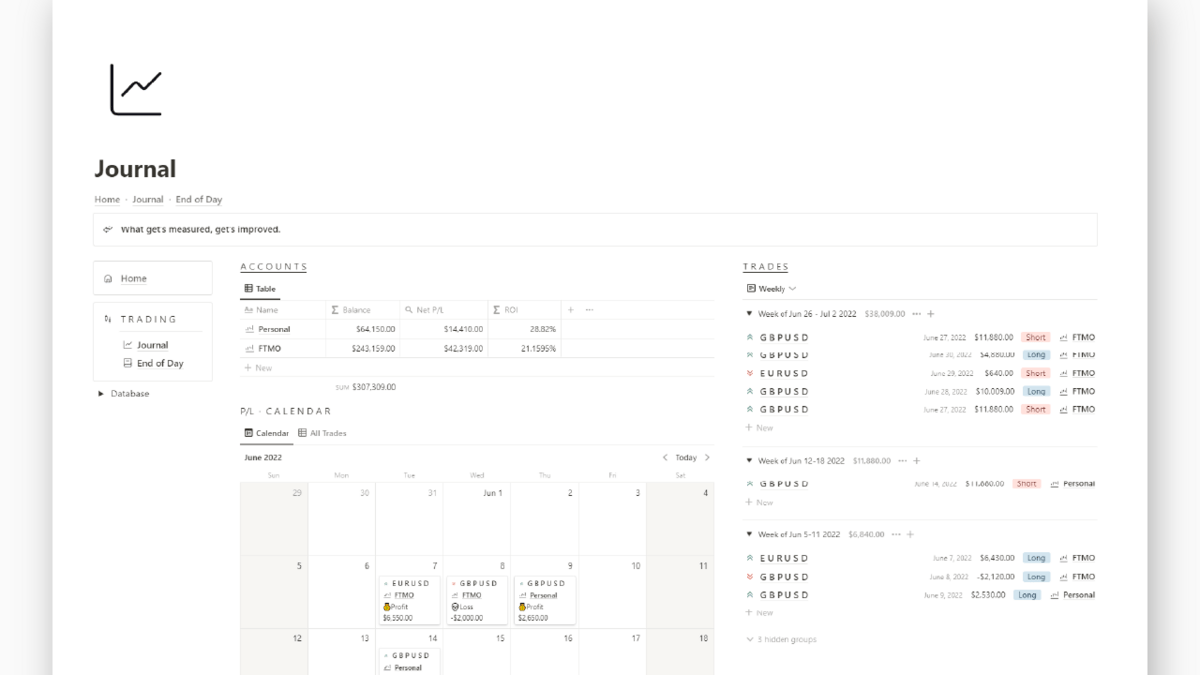

I'm the leading advocate for journaling your trades

Every other day you're going to hear me talk about journaling your trades. It's a massive pain in the ass- especially if you tend to overtrade.. I get it. But I can't stress how important it is to track your metrics.

Every successful entrepreneur monitors their KPIs (Key Performance Indicators) -- These are the metrics that tell you whether you are profitable or not and what areas you need to improve in. I've built a hefty Notion template to help you journal your trades. Track your KPIs as well as your daily, weekly, monthly, annual performance. I've also included an End Of Day Markup tool to help you define your edge or keep your edge sharp, if you've already got on. Grab it below. For reading this far and trusting me with your time I'm taking 20% off.

Follow me on twitter

Normalize impulse control.

As traders it's our job be mentally present when executing our trades. Too often we get lost in the fog of our judgement and emotions and lose sight of what's actually going on when you click that button.

It's ok to slow down.

— B L A C K W A T C H (@BLVKWATCH)

2:21 PM • Jul 26, 2022