- Mid Session

- Posts

- Becoming A Market Expert

Becoming A Market Expert

Pattern recognition is the key to finding a consistent edge

Becoming A Market Expert ~ 5 min read

Pattern recognition is the automated recognition of patterns and regularities in data. It is the cornerstone to machine learning and statistical data analytics. This is also key to being an expert in the financial markets.

Pattern recognition is the key to finding a consistent edge

The key to being an expert in anything is pattern recognition. To be a successful trader, you need to find patterns in the market, your behavior, your emotions, your time management, your ability to get the job done, etc.

There are patterns to everything we do and how we react to certain stimuli. When it comes to trading- we analyze the market through technical analysis which is another way of saying “we analyze patterns.” There are numerous events in the market that will trigger different patterns in our behavior or mental state.

A ranging market might cause us to stare at the charts more. An impulsive market might give us FOMO. A loss might trigger emotions that could cause over trading or revenge trading. A win could give us a confidence boost that propels our trading forward or potentially lead to over confidence and giving profits back to the markets. Discord might take our eyes of our current focus which could lead to missed trades or following someone else’s analysis that may result in a win or a loss.

These are all different events in our day to day lives that could positively or negatively impact our trading. If you are still learning to manage your time and how you trade from day to day— it's crucial to become aware of these patterns, monitor them, track them, and ultimately hone or remove them from your life. We want to determine which patterns get us closer to our goals and which ones take us further away.

We essentially want to be an expert at being ourselves first. Then we apply it to everything else. That means we need to develop, or spot, our own patterns for success and self-sabotage. Whatever comes of this data we need to execute- remove something, add something- take action regardless.

A lot of us tend to ignore the data put right in front of our faces and act purely off of bias and assumptions. Experts don’t do that- they diagnose. They ask questions and they spot patterns. In business, trading or personal development - it’s all the same— Its about figuring out that pattern and determining where the gaps are an how you can use a framework to improve in that area.

Thanks for joining me for this Mid Session chat- See you next time.

-BW

While you wait for the next issue, check out some of my previous posts here:

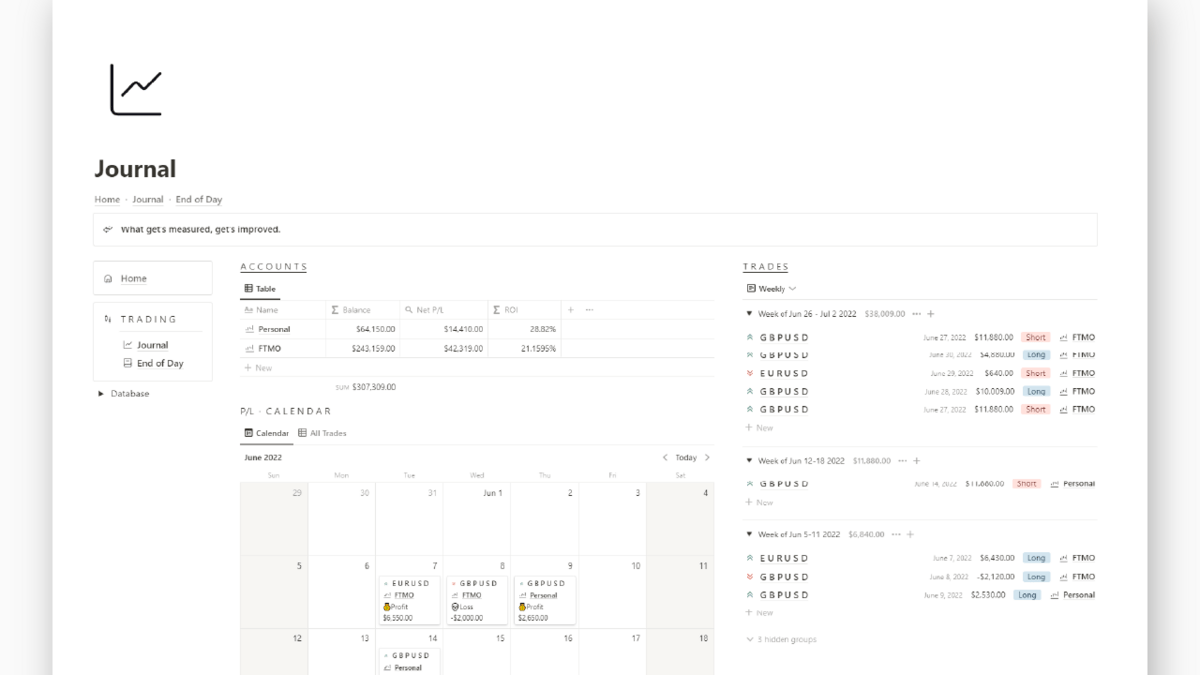

I'm the leading advocate for journaling your trades

Every other day you're going to hear me talk about journaling your trades. It's a massive pain in the ass- especially if you tend to overtrade.. I get it. But I can't stress how important it is to track your metrics.

Every successful entrepreneur monitors their KPIs (Key Performance Indicators) -- These are the metrics that tell you whether you are profitable or not and what areas you need to improve in. I've built a hefty Notion template to help you journal your trades. Track your KPIs as well as your daily, weekly, monthly, annual performance. I've also included an End Of Day Markup tool to help you define your edge or keep your edge sharp, if you've already got on. Grab it below. For reading this far and trusting me with your time I'm taking 20% off.

Follow me on twitter

Unpopular opinion:

Consuming information is not the secret to success. It’s about action and implementation. Experience through application.

Imagine if all you had to do was binge content- everyone would be successful.

— B L A C K W A T C H (@BLVKWATCH)

1:50 PM • Aug 5, 2022